How to Conduct Market Research for a New Business: A Step-by-Step Guide

Starting a new business without market research is like sailing without a map. The risk of failure increases exponentially when you rely on assumptions instead of actual market signals. The good news? Market research isn’t just for big corporations or well-funded startups. With the right approach—and the right tools—you can gain the insights needed to validate your idea, understand your audience, and plan for growth in a matter of hours.

In this in-depth guide, we break down a practical, repeatable framework for conducting market research that fuels real-world traction. Whether you’re launching a new startup, testing a product within an existing company, or exploring market entry opportunities, this step-by-step process will help you make smarter, data-driven decisions. And throughout this guide, we’ll show how GrowthTrust supports every stage of market research with AI-powered insights, expert-reviewed outputs, and strategic clarity—delivered faster than ever before.

Why Market Research Is Essential for New Businesses

Most startups fail—not from lack of effort, but from building solutions for problems that don’t really exist.

Market research helps you:

Avoid wasted development cycles

Uncover unmet customer needs

Position your product clearly against competitors

Justify decisions with evidence (not opinions)

It transforms your idea into a validated hypothesis and your plan into a strategic roadmap. With a tool like GrowthTrust, early-stage teams can accelerate this process—running full market assessments in 24–48 hours, instead of spending weeks scraping together assumptions.

Types of Market Research: Primary vs. Secondary

Understanding the two core types of market research helps shape your approach.

Primary Research

You gather insights directly from your audience:

Interviews

Surveys

Usability tests

Observation

Best for: uncovering specific needs, behavior patterns, or emotional drivers.

Secondary Research

You analyze information collected by others:

Industry reports

Databases (e.g., CB Insights, Statista)

Competitor websites

Public funding or patent filings

Best for: trend identification, market sizing, and landscape scanning.

How GrowthTrust Bridges Both

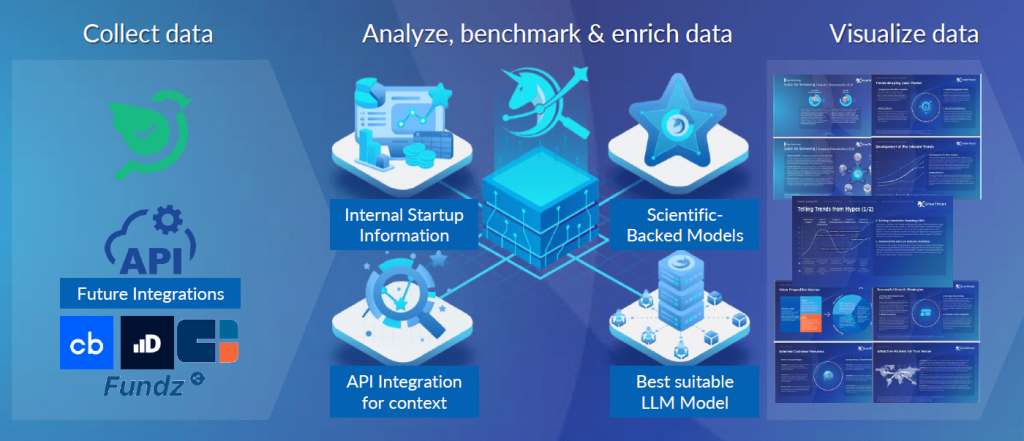

GrowthTrust pulls verified secondary data (market trends, customer insights, competitor profiles) into an easy-to-read analysis. It also includes frameworks like persona matching and strategic fit scoring to simulate the outcomes of primary research—without needing to interview 100 customers.

How to Conduct Market Research

Step-by-step market research process for startups

Step 1: Define Your Market Research Objective

Before diving in, clarify what you’re trying to learn. Focused research leads to focused insights.

Common Objectives:

“Is there real demand for this idea?”

“Who are our ideal customers?”

“Which market segments show the most potential?”

“What are the current competitors doing?”

Don’t research everything at once. Choose 1–2 core questions to answer, then iterate.

Step 2: Identify Your Target Audience

You can’t serve everyone. Research becomes powerful when you define exactly who you’re trying to reach.

Key Attributes to Define:

Demographics: Age, location, income, job title

Firmographics (B2B): Industry, company size, buying roles

Behaviors: Pain points, workflows, tech adoption, buying triggers

Psychographics: Motivations, beliefs, risk tolerance

GrowthTrust automatically builds persona maps using real-time job roles, company info, and behavior patterns—so you don’t need to guess which segment to go after.

Step 3: Analyze Competitors

Competitor analysis reveals what’s already working—and where you can stand out.

What to Look For:

Positioning language (What problem do they claim to solve?)

Product features & pricing

Market traction (Funding, team size, partnerships)

SEO/traffic trends

Gaps in audience focus or regions served

GrowthTrust’s Competitive Intelligence Engine scans your sector for direct and adjacent competitors, delivering side-by-side comparisons and a strategic positioning map—within minutes.

Step 4: Explore Market Size, Demand & Trends

Questions to Answer:

What’s the TAM/SAM/SOM for this product?

Is demand growing or shrinking in this segment?

What macro trends (tech, regulation, behavior) will impact this market?

This is where GrowthTrust shines—automatically pulling market sizing models, growth projections, and regulatory scans from thousands of data points, so you know where the opportunity lies.

Step 5: Run Customer Discovery

If you’re early-stage, a few conversations go a long way. Talk to potential customers to hear what they say—and what they don’t say.

How to Do It:

Ask open-ended questions: “Tell me about how you currently solve [problem]?”

Avoid pitching—just listen

Ask follow-ups: “What would make that process easier?”

Record patterns, not just quotes

Don’t want to do 25 interviews? GrowthTrust simulates persona insights by aggregating relevant sentiment, behavior, and needs across roles and markets—reducing the need for long discovery cycles.

Step 6: Validate with Real-Time Market Data

Once you’ve done the basics, you need validation. That means checking your assumptions against real, dynamic data—not outdated slides.

With GrowthTrust, you can:

Run a 24-hour market assessment using your idea or industry focus

Get insights on market size, competitors, trends, and customer types

Export an investor-ready summary to validate decisions

You can also request expert review to ensure accuracy before pitching or planning execution.

Step 7: Turn Research into Strategy

Good research only matters if it turns into action.

Take your findings and feed them into:

Your product roadmap

Your go-to-market strategy

Your fundraising narrative

Your internal alignment decks

GrowthTrust includes built-in strategic frameworks like SWOT, PESTLE, and strategic positioning maps to help you turn insight into clarity—then into execution.

Common Pitfalls and How to Avoid Them

Mistake #1: Researching too broadly

Fix: Start with one key goal. Expand only as needed.

Mistake #2: Relying only on friends or peers

Fix: Talk to actual target customers or simulate via data.

Mistake #3: Skipping competitive analysis

Fix: Always understand who else is in the space.

Mistake #4: No next steps

Fix: Convert research into a strategy and share it with your team.

How GrowthTrust Makes Market Research Smarter

GrowthTrust was built to give founders, corporate teams, and investors clarity at startup speed.

With tokens, you can:

Run a market scan in under 48 hours

Identify the most promising segments

Validate product direction with PMF scoring

Get expert-reviewed strategy templates

Export board- and investor-ready reports

It’s everything you’d get from a research agency—without the cost, delay, or overwhelm.

From Insight to Execution

Market research isn’t just a checkbox—it’s the foundation of a high-conviction business. The fastest-growing teams don’t guess their way to success. They gather signals early, validate what works, and adjust before spending months building the wrong thing.

With GrowthTrust, you’re not just doing market research. You’re making strategy smarter, faster, and more actionable from day one. Start your free assessment or request a GrowthTrust demo today.